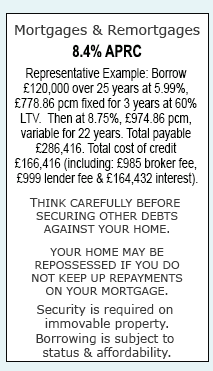

Highest Loan To Value Purchase Mortgages And Remortgages - Low Rate Loans From £5,000 To £150,000 - Release Your Equity With An Equity Release Plan

You are not alone if you are finding it difficult to meet your monthly mortgage repayment on time and there is help at hand to turn this negative situation into a positive. Many of us over the course of our home ownership will require some help to meet the long term payment commitments that inevitably are associated with borrowing the sums needed to buy a home. This is because circumstances change and so do products.

It could be that your mortgage rate has reverted to a higher standard variable rate after coming to the end of a special deal, or your house hold income has changed due to a job loss or starting a family, if not these then perhaps the availability of easy credit has put you into a tough cash flow position and you do not know how to get out of it. Whilst there is not always a solution for everyone many people can and do get back on top of their mortgages, as a provider of mortgage advice to UK consumers for around 25 years we hope and trust that First Choice Finance may well be able to help you turn the corner. For a confidential, no obligation discussion with one of our in house mortgage advice team please call 0800 298 3000 (landline), dial 0333 003 1505 (on your mobile) or fill in our shorton line enquiry form (no credit search carried out) and find out how we can help you get back on top of your finances.

It could be that your mortgage rate has reverted to a higher standard variable rate after coming to the end of a special deal, or your house hold income has changed due to a job loss or starting a family, if not these then perhaps the availability of easy credit has put you into a tough cash flow position and you do not know how to get out of it. Whilst there is not always a solution for everyone many people can and do get back on top of their mortgages, as a provider of mortgage advice to UK consumers for around 25 years we hope and trust that First Choice Finance may well be able to help you turn the corner. For a confidential, no obligation discussion with one of our in house mortgage advice team please call 0800 298 3000 (landline), dial 0333 003 1505 (on your mobile) or fill in our shorton line enquiry form (no credit search carried out) and find out how we can help you get back on top of your finances.Acting Early Will Give You More Options

Remortgaging onto a better rate or to get a longer term can significantly alter your mortgage position, the effect of either option can be used to lower your mortgage payments and therefore to get you back in a positive cash flow position. However the availability of mortgage products and access to the best lender rates is subject to your credit record. The better your credit record the more likely you are to have more mortgage solutions to look at. So the key message here is to address your issues early doors. Avoid waiting until you are actually missing payments altogether as this will be recorded on your credit file and may reduce your options. Fortunately there are lenders available who will consider you as a new borrower even if you have had mortgage arrears, incurred ccj`s or defaulted on credit accounts. These are rarer and can be more expensive, to find out what remortgage solutions we can deliver from our panel of lenders then give us a call or enquire on line and we will can working on your free quotation.

Fortunately there are lenders available who will consider you as a new borrower even if you have had mortgage arrears, incurred ccj`s or defaulted on credit accounts. These are rarer and can be more expensive, to find out what remortgage solutions we can deliver from our panel of lenders then give us a call or enquire on line and we will can working on your free quotation. Main Options Both Borrowing or Not For Mortgage Payments Help

It is important not to jump at the first solution that comes to mind. If you can afford to refinance and put yourself in a better position that seems great, however you need to be confident that you can meet the commitments you agree to over the many years they will extend for. Likewise if you go down a reduced payment route such as Debt Management or even an Individual Voluntary Agreement then you should take into account the long term credit access damage this will cause, including the potential to not be able to move your mortgage elsewhere when it is due for renewal. Some primary routes to dealing with difficulty meeting mortgage payments are listed below:- Borrowing Solutions

- Remortgage your current home to a different product at a lower interest rate with your current lender or a new lender to get your payments down

- If other credit cards, loans or finance agreements are impacting badly on your cash flow, leaving you paying out more than you earn then you may want to consider a debt consolidation loan. This is a larger personal or secured loan used to pay of your existing credit items and spread the payments over a longer term to get the payment down. Note you well may pay more interest over the term.

- Transfer credit cards that are costing you high interest to interest free or similar, to get your outgoing down for a while whilst you get on top of your affairs. Look out for transfer fees and bear in mind the interest free period will only last so long.

- If you cannot get a personal loan because of your credit rating and do not want to try a secured loan (these are more flexible as they allow adverse on some plans provided you have the equity to offer as security for the money) then you could look at a Guarantor Loan whereby you can get a loan provided someone will back your payments. This person needs to usually be a homeowner with an income, who is prepared to cover the loan payments if you cannot. These can accept high levels of adverse credit, or even no credit history applications.

- None Borrowing Methods To Consider

- Speak to your Mortgage Lender and slowly read through all your mortgage documentation. Find out where you stand. The lender must try to help you, so start negotiations with them as soon as possible. It is not in their interests to damage their reputation and put you off them for life by repossessing you, so be open, frank and honest and try to come up with a compromise you can afford and they will allow. Meanwhile seek means of getting more income in and keeping your other debts to a minimum.

- Enter into a Debt Management Plan. This is an informal agreement where you ask your creditors to let you pay them less per month than you originally contracted to do so. You can do this yourself or go to a DM company who will do the legwork but keep a percentage of what you can afford to pay for doing so. These can go on for some time and your credit record will be adversely affected, restricting your access to loans, mortgages and finance for many years to come, but it may enable you to meet your mortgage commitment by bringing your other finance bills down.

- Enter into an Involuntary Arrangement. This is different to a Debt Management plan. It is a contract with a fixed term, normally 5 years, during which you agree to pay your creditors an agreed amount. At the end of the period the remaining debts are no longer due. This will also have a long term negative affect on your credit record and finance access.

- Ask the family to help. If you have a mixed age household, you may be surprised how much grandparents or children living with you or elsewhere may be prepared to support you during difficult times. If you think there is a chance, it is probably worth asking.

- Seek legal advice. If you cannot afford a solicitor then contact your local customer advice bureau. They are there to help and will be listed in your local phone book and online. These may have yet more options that have not been covered here.

Making Reparations After Mortgage Arrears

If you do go into arrears, the first thing is not to panic. Sit down, with a pad, pen and calculator or a computer with spreadsheet ability and write down what you owe and what you pay and everything you spend money on. This is the first step to recovering your position. Then start looking at what you can cut out or reduce. The good news is once you get out of mortgage arrears after about 12 months of on time payments most lending institutions will ignore them when considering you for new products.Mortgages & Remortgages |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential